BLOG - It Is Time for the Next Binding Agreement

The collapse of the Rana Plaza building on the 24th of April 2013 which caused the death of 1,138 people led to the establishment of the Accord for Health and Safety, a binding agreement which has made 1,600 factories in Bangladesh safer. Since 2013, Accord engineers have carried out over 30,000 inspections. The remediation progress rate at Accord factories is at 92 percent. It is the only area in the textile industry that has seen actual improvement in working conditions since the “wake up call” that many in the garment industry declared the Rana Plaza collapse to be. The experience has shown that a binding agreement between brands and trade unions has the capacity to tackle a longstanding problem, improve the lives of workers, while being cost-effective for brands. The time has now come for the next binding agreement to address another longstanding problem: wage and severance theft.

In January 2022, the closure of Vald’or, a garment factory in Haiti, left over 1,100 workers unemployed and without severance pay. The factory produced clothes for brands such as Tommy Hilfiger and Calvin Klein, owned by PVH. After the Worker Rights Consortium (WRC) intervened, PVH agreed to pay $1 million in compensation to cover missed severance pay, pension contributions for the workers, and the government pension fund. Wage and severance theft has become one of the key Environmental, Social and Governance (ESG) risks to take into account in the Textile, Garment, Shoe and Leather (TGSL) industry. Wage theft refers to the illegal withholding of wages or benefits owed to workers, while severance is the compensation paid to workers who have been laid off due to business closures or restructuring. While it is difficult to quantify the magnitude of wage and severance theft globally, studies and reports have highlighted the widespread nature of the issue in the TGSL industry. Wage and severance theft is unlawful, and therefore a key ESG risk for investors and especially for so-called Article 9 Funds, as defined by the European Union’s Sustainable Finance Disclosure Regulation (SFDR). These funds have a responsibility to ensure their investments contribute to ESG objectives.

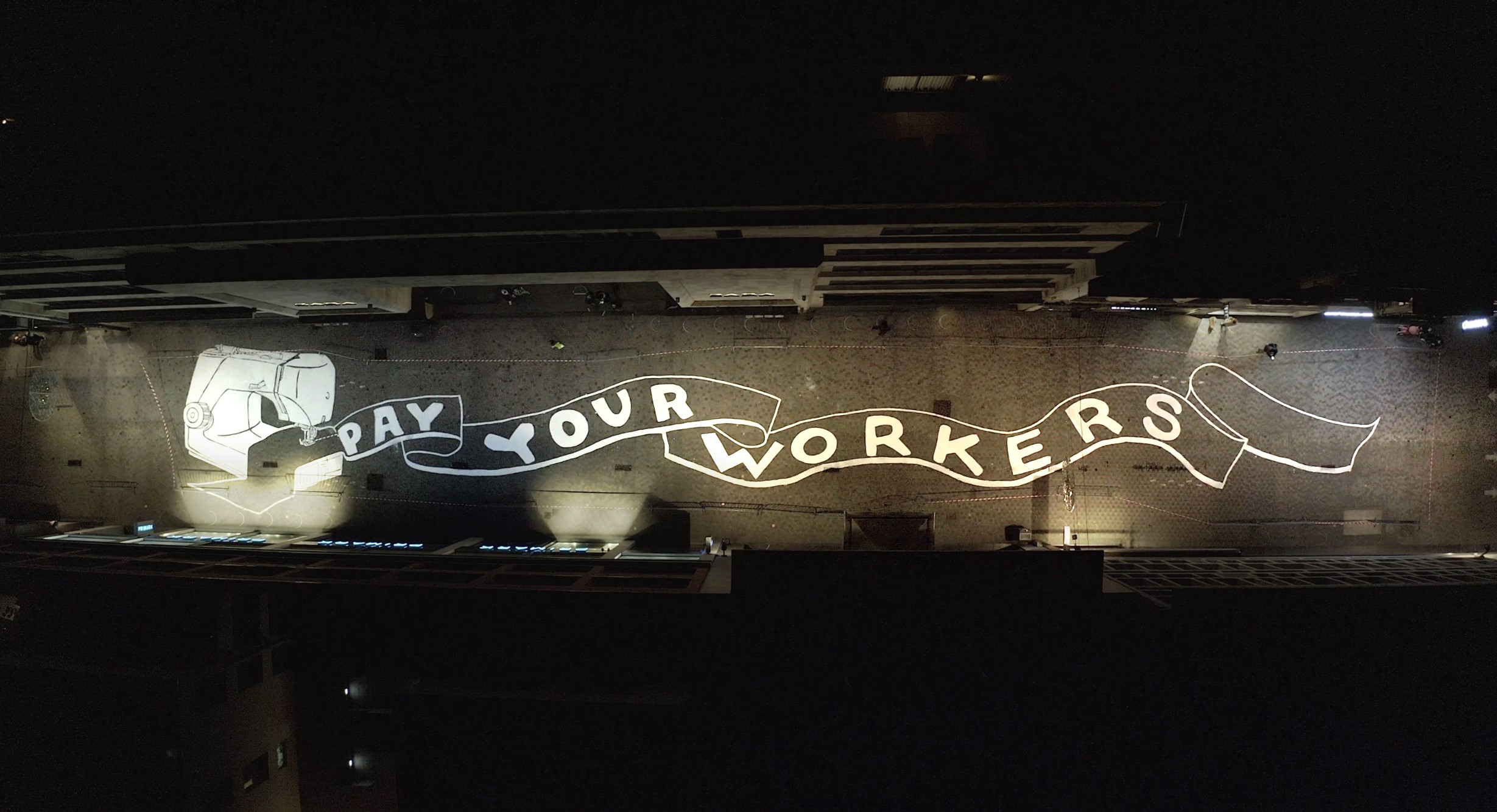

To ensure workers in the global TGSL industry receive the wages and benefits they are entitled to, a binding and enforceable agreement between brands, employers and unions is needed. The Pay Your Workers - Respect Labor Rights (PYW-RLR) agreement is a legally binding and enforceable agreement proposed by over 40 unions active in the TGSL industry and supported by more than 280 endorsers. If brands sign the agreement they commit to establishing a Severance Guarantee Fund where workers can file a claim if their employer is unwilling or unable to pay, they commit to settling any outstanding Covid-related wage theft, and they commit to setting up an independent mechanism to investigate and remedy violations of basic labour rights. The agreement is foreseen to be governed through an independent body with an equal number of seats for unions and companies. The total premium, along with the estimated cost for brands to cover unpaid wages and benefits and establish the independent inspectorate, will not cost brands more than ten cents per t-shirt.

It is not just a matter of ethics and social responsibility for brands to ensure their workers receive their contractual payment. In several European countries, such as France and Germany, human rights and environmental due diligence is now required by law. Such legislation was not present in 2013 impeding workers in the Rana Plaza building to effectively hold brands accountable. Due diligence is about to become mandatory for many more businesses as the European Commission is working on a directive that lays down due diligence obligations for companies in the EU. Brands and retailers with cases of wage and severance theft in their supply chains now face several legal risks, including fines and penalties, exclusion from public contracts, civil liability and regulatory action. If a brand does not comply with the requirements of the German Supply Chain Act, for example, and fails to take appropriate preventive and remedial measures to address wage and severance theft risks in its supply chain, it may ultimately face fines of up to two percent of its average annual global turnover. This could have a significant financial impact on the company.

For brands, the PYW-RLR Agreement is a cost-effective due diligence solution that addresses several critical aspects of supply chain management, risk mitigation, and legal compliance in a systematic and comprehensive manner. On the contrary, identifying and redressing wage and severance theft on a case-by-case basis can be resource-intensive, time-consuming, and attract negative publicity. Investors can use their leverage to encourage companies to address wage and severance theft, as well as directing finance towards those brands that commit to signing the PYW-RLR agreement. They can introduce assessments of company performance in relation to the payment of wages and severance, and integrate these concepts into ESG metrics, modelling frameworks and rankings. Investors can also include participation in the PYW-RLR agreement as a criterion or indicator when appraising a (potential) investee’s ESG performance. Investees that do not address the risk of wage and severance theft should be excluded from Article 9 funds.

Ten years after the devastating Rana Plaza collapse, we must conclude that brands have not „woken up“ as much as they professed right after the collapse. In Bangladesh and beyond, workers still face poverty wages, gender-based violence, limitations on their right to organise and on top of that, wage and severance theft. The only thing that has improved despite brands’ fine words in other areas has been the safety of the factories they work in. It is time to extend progress beyond health and safety and for brands to sign the next binding agreement.

By Ineke Zeldenrust, Clean Clothes Campaign International Coordinator

This article was published on 19 April 2023 on ESG Table.